What if You Cant Afford to Pay a Lawsuit

A letter arrives from a law office threatening a lawsuit for payment on an old bill. It'southward upsetting, only hardly rare.

You may go hit with a debt drove lawsuit if you accept old, unpaid medical, credit card or other consumer debt. If you don't respond in time or attend the court hearing, the creditor is likely to win — and may get the right to have part of yourwages or depository financial institution account.

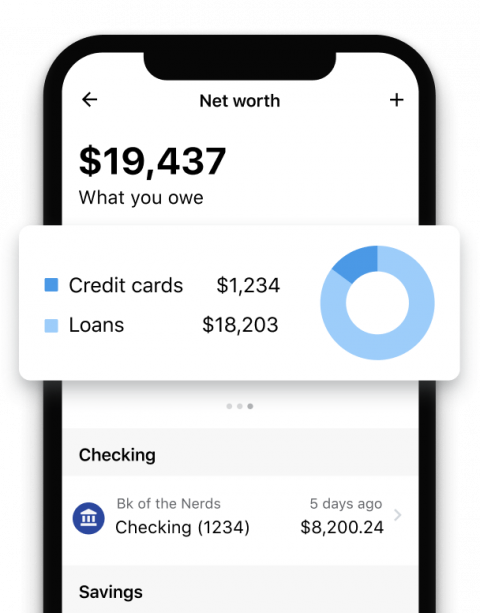

Picket your debts dwindle

Sign up for an business relationship to link your cards, loans and accounts to manage them all in one identify.

In this article:

What happens when you get sued for debt

Lawsuits are a common and efficient debt drove tactic. In New Jersey, for instance, debt collection lawsuits accounted for 48% of civil judgments in 2011, according to a ProPublica report . One attorney at a debt collection house filed 69,000 lawsuits in a unmarried yr, it found.

A debt collection lawsuit begins when a creditor files a complaint with a country civil court listing yous every bit a defendant, along with your co-signer if you have one. The complaint will say why the creditor is suing you lot and what it wants. Typically, that's the money yous owe plus interest, and perhaps attorney fees and court costs.

The creditor, collection agency or attorney representing information technology will then notify you of the lawsuit past "serving" yous, which means delivering a copy of the complaint and a courtroom summons. The summons has information about when and how you lot can file a formal response in court, and the date of your court hearing.

Debt collectors bet that most people won't attend their hearing, leaving the judge to file a default judgment. With a default judgment the creditor may exist able to:

-

Place a lien against your property.

-

Try to freeze part or all of the money in your bank account.

That's why you need to respond to the complaint and summons. Hither's what to do.

Gather information

The creditor suing you is unlikely to be your original creditor. The debt may take been sold, possibly several times over. Information technology may be something yous recognize, or information technology may exist an former neb long forgotten — now a zombie debt — that a debt collector has revived.

Review your ain records and any data you got in the mail, including the validation letter of the alphabet that the debt collectors must send. Determine:

-

Who the creditor is, whether the amount is accurate and whether you actually owe the debt. Errors creep in as debt is sold and resold; names and amounts tin can be incorrect.

-

Whether the debt is past the statute of limitations . Once that passes, the debt is considered "time-barred." That ways you lot can't legally exist sued — but collectors may even so effort it, in violation of your consumer rights . Your obligation to pay time-barred debt remains, however, and the unpaid debt will keep to hurt your credit.

Don't delay. Yous generally accept 20 to 30 days from when you go served to file a response.

Reply to the lawsuit

"The worst thing anyone can practice is ignore the lawsuit," says Ira Rheingold, executive managing director of the National Clan of Consumer Advocates. That puts your wages, bank account or property at risk. Worse, y'all can as well lose the ability to dispute that y'all owe the debt.

Organizing your defense force and writing the response can be complicated, so you may want to consult an attorney. Frequently, attorneys will provide a free consultation, and if you win your case the debt collector likely will take to pay your legal fees. Many local legal aid offices offer low- or no-cost services. War machine service members can become assistance from their local estimate advocate general office.

An attorney can:

-

Point out defenses you weren't aware of.

-

Help you write your formal response.

-

Represent y'all in courtroom, if necessary.

Guidance from an attorney tin can help you write a more consummate response, which might brand the creditor more likely to pursue a deal with you. If y'all become a step further and attend the hearing with an attorney, Rheingold says, the collector "likely won't be able to verify the debt and it might get dismissed."

You probably volition have to pay a fee to file your response. Inquire the court clerk for information about fee waivers if you can't beget the fee.

Options for handling the hearing

Showing up for your hearing is crucial. This is when the judge volition make up one's mind whether you have to pay, and it'south your risk to make your defense or work out a deal with the creditor.

How you lot handle it depends on whether you lot owe the debt.

If you owe the debt

You have a few options. Seek out the creditor before the hearing begins and see if you can concord to:

-

Fix up a payment plan where yous make regular, affordable payments on the bill until you pay it off.

-

Settle the debt for less than you originally owed. If you tin strike a deal, be sure to get a written agreement that says the creditor will consider the debt fully settled and will report it to the credit bureaus every bit paid.

Credit counseling from a nonprofit credit counseling bureau can assistance you comb through your finances to embrace a payment program or settlement. If y'all nonetheless tin't beget to pay the amount you owe, you may want to pursue a debt relief option , such as bankruptcy , for a fresh start.

if you incurred the debt, but recall you shouldn't have to pay

There are several instances in which you might have standing to decline to pay a debt. You may be able to invoke these so-called affirmative defenses if, for example:

-

What you bought was defective or never delivered.

-

The debt contract was unenforceable or illegal, or you signed it based on falsehoods.

-

Yous canceled the contract within the lawful time frame.

These are but a few of the possible affirmative defenses. If yous recall you lot might have such a defense, seek legal advice on the best way to proceed.

If you don't owe the debt

When you're sued for a debt you lot don't owe or for an amount you dispute, two words tin give y'all a strong defense: "Prove it." At the hearing, you can ask the creditor to provide the original debt contract and to prove why you owe the amount specified. If information technology tin't, the estimate may dismiss the case.

Adequate documentation is key, but also seek the aid of a qualified legal professional to help you navigate this process.

A lawsuit for a debt you don't recognize may be the result of identity theft, so you may want to cheque your credit report for activeness you don't recognize.

Source: https://www.nerdwallet.com/article/finance/sued-for-debt-what-to-expect

0 Response to "What if You Cant Afford to Pay a Lawsuit"

Post a Comment